#huobi exchange

Explore tagged Tumblr posts

Text

#- **HTX**#- **Huobi**#- **Crypto Trading**#- **Bitcoin**#- **Ethereum**#- **Cryptocurrency Exchange**#- **Blockchain**#- **Secure Platform**#- **Global Users**#- **Investing**

2 notes

·

View notes

Text

0 notes

Text

World Top Cryptocurrency Exchange in India

CoinCred Pro is a global cryptocurrency exchange that offers a wide range of features and services to its users, including high liquidity, low fees, and a user-friendly interface. It is one of the most trusted and reliable cryptocurrency exchanges in the world.

#Binance#Coinbase#FTX#Kraken#Huobi Global#best app for crypto trading in india#top 10 crypto exchange#cryptocurrency#crypto exchange#bitcoin#switch coin#dcx

1 note

·

View note

Text

On a dead-end road that climbs out of the tiny city of Jenkins, in the foothills of the Appalachian Mountains in Eastern Kentucky, there stands a large warehouse with a mint green roof. It shares the road with a few other businesses, but is otherwise surrounded by an expanse of open fields and tree-lined slopes. Inside, the warehouse is stacked high with racks on racks of computers—thousands of them. But none have ever been switched on.

The warehouse is owned by Mohawk Energy, a company cofounded by Kentucky state senator Brandon Smith in 2005, originally to resculpt landscapes disfigured by coal mining. After lying dormant for a period, Mohawk was reincarnated in 2022 when Smith struck a deal with HBTPower, a company then owned by Chinese crypto exchange Huobi, which wanted to use the warehouse for a bitcoin mining operation.

Under the deal, Mohawk promised to fit up its warehouse with the necessary power infrastructure, operate the equipment, and funnel any bitcoin produced to HBT. In return, HBT would pay Mohawk a monthly hosting fee, a cut of its mining revenue, and the associated energy bills.

Smith says he hoped the arrangement would generate tax revenue and create jobs for former coal miners, who could be trained as repair technicians. The coal industry departed Jenkins long ago, the reserves depleted, leaving people in search of work. More than a third now live below the poverty line, per the latest census data. “I liked the idea of going from one type of mining to a new type,” says Smith. “I thought, now in Eastern Kentucky we are going to have our time—we’re going to catch up and play a part in the tech future.”

But after a promising start, the relationship between Mohawk and HBT soured and then fell apart. “Nothing has ever been turned on. It’s a fascinating, almost Willy Wonka–type atmosphere when you walk through,” says Smith. “It has turned into a disaster.”

In November 2023, HBT brought a lawsuit in federal court, alleging that Mohawk had breached its contract on several fronts, including by failing to install the appropriate power infrastructure and secure certain power subsidies, and attempting to sell off the mining equipment. “Ultimately, the source of the current dispute is Mohawk’s basic failure to comply with its obligations, not only in a timely way, but at all in many regards,” says Harout Samra, a specialist in international dispute resolution at law firm DLA Piper and representative for HBT.

Mohawk sued HBT in return, contesting the various alleged breaches and claiming that HBT is delinquent on more than $700,000 in rent, labor, and fit-up costs. The company is also seeking damages relating to the loss of income over the term of the contract and the inability to bring a new tenant into the facility while the equipment remains on-site. “Huobi simply made a bargain it believes now is a bad one, and wants to get out of it without paying the funds it owes,” the filing states.

The legal conflict, which remains unresolved, is just one in a series of fights between Chinese companies and the owners of industrial facilities in the rural US over failed bitcoin mining partnerships. What looked to facility owners in Kentucky like an irresistible opportunity to tap into a new line of business in an otherwise fallow period has turned into a nightmare. They claim to have been saddled with unpaid hosting fees and energy bills worth hundreds of thousands of dollars, with few options for recovering the money. The Chinese parties have been left equally displeased. “HBTPower obviously regrets that this opportunity has ultimately played out the way it has,” says Samra.

The bitcoin mining game—a race between computers to win the right to process a bundle of transactions and claim a crypto reward—is dominated by large corporations that own and operate industrial-scale facilities. But in 2021 and 2022, smaller-scale operations began to proliferate in the US countryside wherever there was available power, including in Kentucky. “A lot of mom-and-pop shops opened up,” says Phil Harvey, CEO at Sabre56, a firm that consults on crypto mining projects and operates its own facilities. “Appalachia has always been a good source of power.”

These small facilities were plugging a gap in the market. A ban on crypto mining in China had left businesses casting about for a new home for their many millions of dollars’ worth of mining equipment. “A lot of wealthy Chinese businesses were affected,” says Harvey. “Every minute these machines are down, they are losing revenue.” Meanwhile, as the price of bitcoin ballooned—and the profitability of mining along with it—mining firms and investor groups began to hoard large quantities of bitcoin mining equipment of their own, says Harvey, without considering where they might deploy it.

In an overheated market, holders of mining equipment jumped into hosting arrangements at short notice with owners of small facilities, some of whom had no prior experience and insufficient expertise, who agreed to install the equipment and run the mining operations on their behalf.

But the haste with which these hosting relationships came together, in the name of striking while bitcoin was hot, says Harvey, set many of the partnerships up for failure. There was limited due diligence conducted by parties on both sides, delays in kitting out facilities and deploying equipment, and disputes over payment terms, he says, among other points of friction. “It's a snowball effect where everyone just ends up getting pissed off with each other,” says Harvey.

Though the American market proved more expensive and bureaucratic than some Chinese businesses expected, says Harvey, problems were also caused by the hubris of facility owners, some of whom found themselves in over their heads. “It’s no joke running a [bitcoin mining] operation of any kind of scale,” he says. “Just because the Chinese are tough to do business with, doesn’t mean they are the ones in the wrong. I would say that blame is equally shared.”

The law firm acting for Mohawk in its dispute with HBT, Anna Whites Law Office, has represented multiple owners of small facilities in Kentucky in similar legal conflicts with Chinese partners. The cases differ from the Mohawk situation, says attorney Anna Whites, founder of the firm, but share a common thread: “We saw a pattern that [companies with ties to China] would ship in machines with uncertain provenance, mine very heavily for three months, then run without paying the bill,” she claims.

Some of the cases settled out of court; Whites is unable to supply the details for reasons of client confidentiality. But others continue to drag on.

Biofuel Mining, a company formerly co-owned by Smith, is involved in legal tangles with two companies that Whites believes to be run out of China: Touzi Tech and VCV Power Gamma. Although both are incorporated in Delaware, per SEC filings, they conduct business in Mandarin and cannot be reached at their listed US addresses, Whites claims. “It's pretty standard for the foreign entities from any country to get a short-term office so that they have less scrutiny from US investors and government agencies,” she says.

In both cases, Biofuel claims, the firms shipped equipment from China to its hosting facility in Eastern Kentucky, then walked away with the bitcoin produced, leaving behind hundreds of thousands of dollars in unpaid energy bills and hosting fees.

Biofuel reached a settlement with Touzi in early 2022 for $60,000, but despite having handed back the mining equipment, it claims not to have received the sum it is owed under the agreement.

In the still-unresolved spat with VCV, Biofuel received permission from the Martin County Circuit Court in Kentucky to sell off the mining equipment, claims Whites, to recoup a portion of the funds it is owed (she has not confirmed the amount), but she alleges that no damages have yet been awarded. VCV has stopped responding to communications, she claims.

Biofuel has since dissolved, put out of business by the failed hosting ventures. “I literally lost my house—I lost everything. It financially ruined me,” says Wes Hamilton, former Biofuel Mining CEO. “I’m just so frustrated about the whole thing.”

WIRED contacted VCV and Touzi for comment, but did not receive any response.

There are few financial recovery options for companies like Mohawk and Biofuel. The situation is made more difficult, as in the Mohawk case, if they are dealing with so-called special purpose entities. Because they are set up by their parent companies for a single specific business venture, these entities need not be concerned about their long-term ability to operate in the US.

“It certainly can be more difficult to recover damages from a non-US counterparty,” says Kim Havlin, a partner in the global commercial litigation practice at law firm White & Case. “There is certainly a risk that an entity that doesn’t need to be in the US may just ignore the case.”

Even if the Kentucky facility owners win out in court, it could be difficult to collect any damages awarded. “A judgment is essentially a piece of paper. Any judgment needs to be turned into assets or cash in order to be valuable,” says Havlin. If the opposing party refuses to pay up and has no US assets to collect against, sometimes that isn’t possible.

Almost a year after the dispute began, the Mohawk case is stuck in legal limbo. In a setback for Mohawk, the presiding judge recently denied its motion to dismiss HBT’s complaint, on the basis that it had failed to sufficiently back up its argument. The judge also pushed Mohawk’s countersuit into arbitration, a forum for resolving disputes privately instead of in open court. Non-US parties tend to prefer arbitration as a way to “remove a home forum from both sides,” explains Havlin. “You can pick an arbitral seat in neither country as a means of creating a neutral playing field.” A parallel federal court hearing is set for December to consider whether an injunction should be imposed on Mohawk, preventing it from selling off the remaining HBT equipment in its possession.

Smith has given up on the idea of recovering the full amount he claims to be owed. “We’re at the point that it’s almost silly to even be arguing about breaking even,” he says.

In an interview with PBS that aired in September 2023, touting the Mohawk Energy facility, Smith said he hoped to prove that not every business that blew into Jenkins would abandon the area. “I’ve stood at their ribbon cuttings, then watched them leave. I’d like to do something to let people know that not everybody is like that,” he said.

After the relationship with HBT collapsed last year, Smith faces the prospect of Mohawk becoming yet another false start. With the facility inactive, the company has been forced to dismiss the former coal miners brought on as technicians. (It is unclear how many people it employed.)

The Mohawk facility was perhaps never set to revitalize Jenkins in the way Smith hoped, anyway. “I would say that a rural community benefits very little from a bitcoin mining facility. In terms of job creation, it’s minimal in a lot of cases,” says Harvey, the consultant. “It's certainly not the savior to a dwindling community.”

Nonetheless, Smith remains hopeful of salvaging the crypto mining project, with a new partner. “I’m hoping that this gets settled in the way that it should and that somebody comes forward and lets us go through with the vision that we wanted for this region,” he says. “I hope every day that maybe some big company will see that there's a place ready to go in this part of the country.”

Otherwise, Mohawk’s dalliance with bitcoin mining will become a cautionary tale. “It was very hurtful to see these families lose their income. We were one of the biggest payrolls in Jenkins,” says Smith. “It adds insult to injury that I’m sitting here arguing in court.”

20 notes

·

View notes

Text

✅ ENTER NOW AND EARN BIG!

🚫 [No money depositing required!]

Is this project the next big thing?!

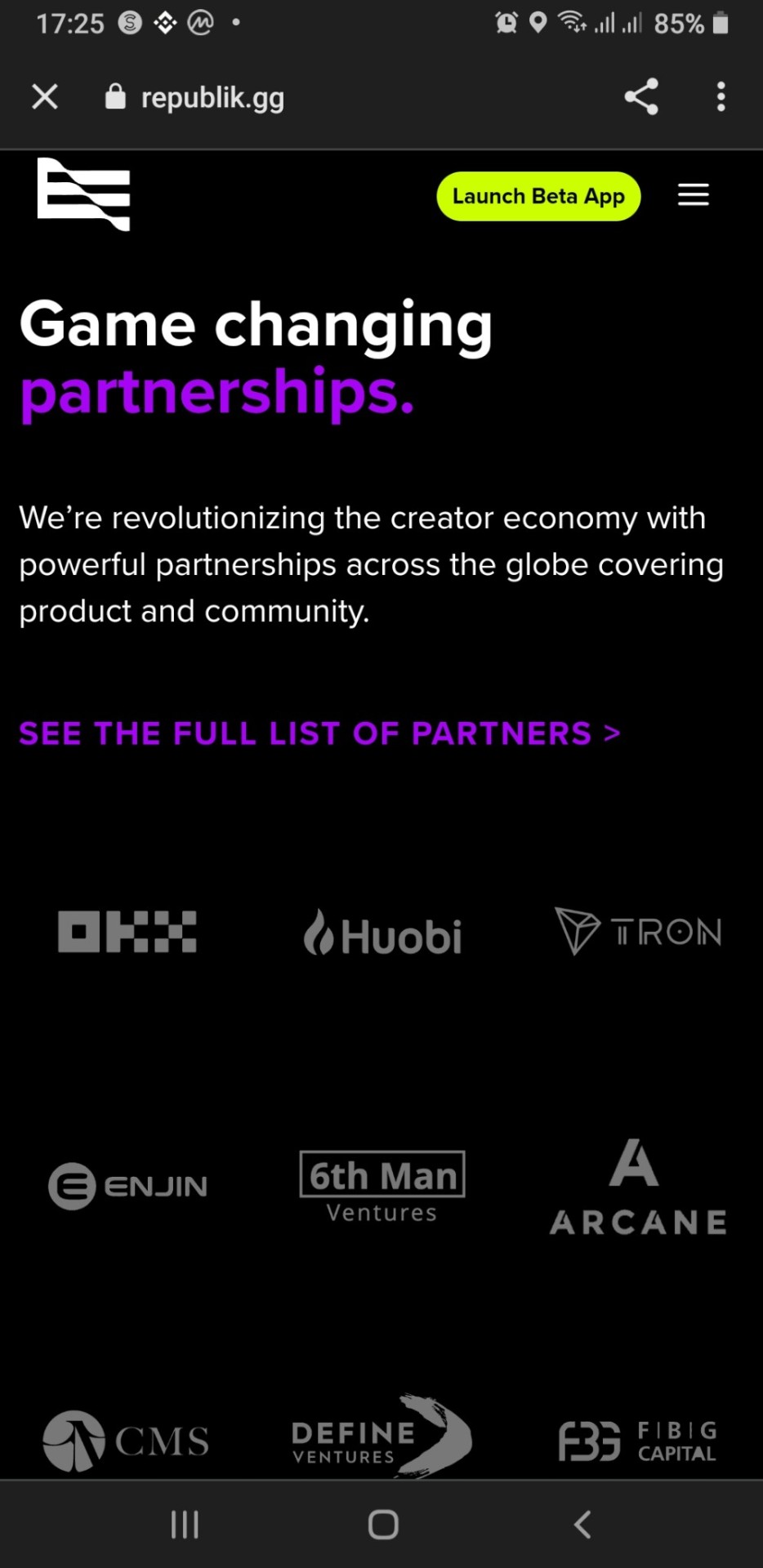

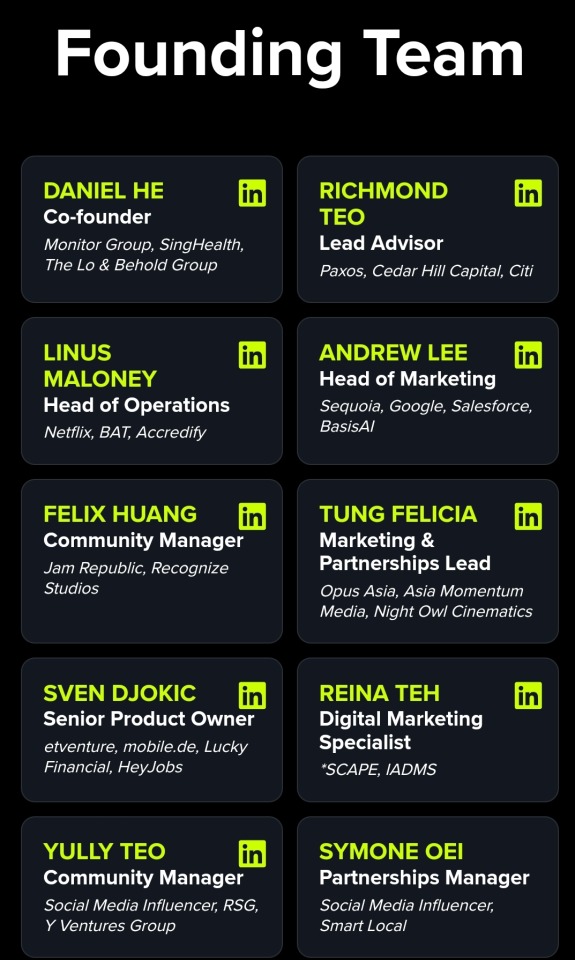

First, just have a short look at the big investors and the working team behind this project to come with a conclusion!

I mean...investors like OKX and Huobi (two of the biggest trading exchanges in the world), TRON (one of the biggest cryptos in the world)...and ex Google and ex Netflix team members...do you really think they will invest in something rubbish?! I dont think so! (See the pics below.)

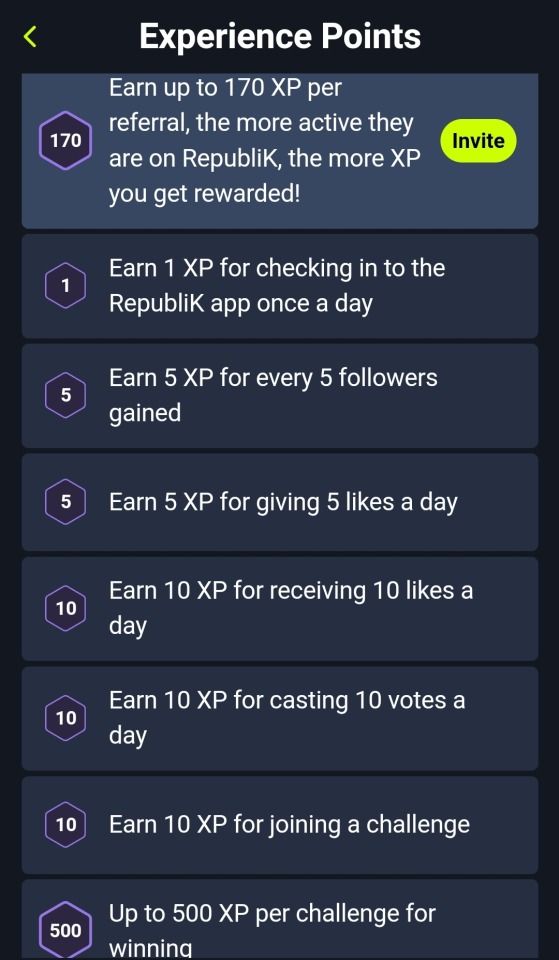

So, all you have to do is, just start earning daily rewards and enter now in this project or in this recently released social app to grab this rare oppertunity of earning the next upcoming new token, in the earliest release stage!

You probably know what this really means, right?

If you eventually don't know, than we'll tell you: you will literally earn a digital money which has a real potential to go from 10x - 100x or more! These insane growings usually happen at the begining (the earliest stage of a token release to the market!) of a token or coin!

It is like you are paid to use Fcb and Insta daily, but along them you have to use this other social app we are talking about!

The app is called Republik.

You will be paid from your usual daily social activity like: posting, liking, receiving likes, following, getting followed, inviting others to join you ect. It is sufficient to stay there several minutes per day or less!

The payment will be in XP rewards as for now which soon will be converted to this upcoming new token called RPK which will be the official token of this app.

These tokens will be released at the end of this year, according to this unique app.

So, hurry up and grab this unique offer of earning big whithout spending any money at all...

(See the pics below for more details.)

Join here and start earning daily immediately: https://app-link.republik.gg/uZU3O0tzADb

*

*

*

*

#Republik #earnmoney #makemoneyonline2023 #crypto #makemoneyfromyourphone #BTC #dogecoin

#health & fitness#big man#weight loss#travel#thick thighs#crypto#make money online#btc news#curvy and thick#thick white girl

3 notes

·

View notes

Text

Best 10 crypto exchanges for futures trading in 2023

I can provide information on some of the top cryptocurrency futures exchanges based on their reputation, trading volume, and features.

Binance Futures : One of the largest and most popular cryptocurrency exchanges in the world, Binance offers futures trading on a wide range of cryptocurrencies.

BitMEX : A well-established futures exchange that offers Bitcoin and Ethereum futures trading and has a reputation for high leverage and advanced trading features.

Bybit: A popular futures exchange that offers Bitcoin and Ethereum futures trading and has a user-friendly interface.

Huobi Futures : A large cryptocurrency exchange that offers futures trading on a variety of cryptocurrencies and has a reputation for security and reliability.

OKEx: A well-known futures exchange that offers trading on a variety of cryptocurrencies and has a reputation for security and reliability.

Deribit : A popular futures exchange that specializes in Bitcoin and Ethereum futures trading.

Kraken Futures : A cryptocurrency futures exchange that offers trading on a variety of cryptocurrencies and has a reputation for security and reliability.

CoinFLEX: A cryptocurrency derivatives exchange that offers Bitcoin and Ethereum futures trading and has a reputation for transparency and fairness.

Bit.com: A Bitcoin futures exchange that offers trading on a variety of Bitcoin futures contracts and has areputation for transparency and reliability.

It's important to note that each futures exchange has its own fees, user interface, and security features, so it's important to do your own research and choose an exchange that meets your specific needs and preferences. Additionally, futures trading is highly speculative and carries a significant risk, so it's important to consult with a financial advisor and understand the risks involved before engaging in futures trading.

If you want more detailed information about Best crypto exchanges for futures trading in 2023, you can visit this article, as it contains all the details you need for this matter.

Best 10 crypto exchanges for futures trading in 2023, cryptocurrencies for futures trading

2 notes

·

View notes

Text

New Post has been published on RANA Rajasthan Alliance of North America

New Post has been published on https://ranabayarea.org/how-to-mine-bcn/

How to Mine BCN

To mine DOGE, first ensure you have a wallet to store your earnings. You can download the Dogecoin core wallet or look on the website for other suitable online wallets. When mining using your CPU, the software that works best is CPU miner. AMD and Nvidia cards are your best bet (see below for details on building mining rigs). If you decide on GPU mining, then the software you should use is either the cgminer or cudaminer.

If you are considering using GPU for mining, a software called XMRIG is mainly used by BCN miners.

The reason for the price differential is all about performance.

Once mined, exchanges that trade Bitcoin Gold include Binance, BitfinexHitBTC and Huobi Global.

Bytecoin is a CPU-mined currency, which is why it is very attractive to people.

No one will know the wallet address from where the coins came from.

Forming an LLC can be beneficial to cryptocurrency miners, but it typically won’t save you any money on taxes. If you make over $100,000 per year from crypto mining, you might consider forming an LLC and using an S-corp election to save on taxes. Enterprise-ready solutions based on Bytecoin blockchain technology is your chance to start the safest business cooperation.

It is the value of a cryptographic one-way function of the secret key, so in math terms it is actually an image of this key. One-wayness means that given only the key image it is impossible to recover the private key. On the other hand, it is computationally impossible to find a collision (two different private keys, which have the same image). Using any formula, except for the specified one, will result in an unverifiable signature.

If everyone continues joining the largest pool, it will eventually grow to control more than 51% of the network hashing power, leaving the network vulnerable to double spending. I don’t want to go into too much detail here because there are so many different payment schemes, but you’ll want to find out more about the benefits and disadvantages of each. If it’s too high you could be waiting weeks to receive any coins from your mining efforts. We tend to think of this as Monero, since it is the most popular, but Bytecoin actually was released much sooner than Monero. Bytecoin is interesting because it has an enormous total supply at 184,470,000,000 coins. This is not the end for the Pi Zero however, there are other coins and other uses.

You can solo mine, but the payouts could take months depending on how powerful your mining rig is, and the mining pools usually charge a very small fee (1% or less). Using a pool will allow you to receive consistent payouts, multiple times per day. It has a Proof of Work cryptocurrency dubbed “BCN” that’s the gas that powers the Bytecoin ecosystem.

Is crypto mining hard?

Yes. Anyone can mine Bitcoin. However, as the difficulty of mining Bitcoin is high due to competition, you'll need dedicated equipment, including a high-performance mining rig. These cost several thousand dollars, and this cost is often a barrier to entry for those interested in mining Bitcoin.

current community

I found that at least for the CPU, the program usually generates the best possible configuration settings automatically. The comments in the cpu.txt do a great job of explaining each setting, and how you could try to get more performance out of your machine. They support most of the Cryptonight coins, so you can just type the name of the coin, from the list in the txt file. If the coin you want to mine is not on the list, you need to know what algorithm it uses, and use the algorithm name for the currency.

How To Mine Bytecoin

Although miners split the reward after mining a block, pool mining is extra worthwhile than solo mining. Crypto mining is a web-based course of which involves solving advanced mathematical puzzles. To achieve this, you need to have powerful Bytecoin hardware, because it’s a trial and error process. Higher hash rate (number of calculations) lets you clear up them faster and ensures better chances of receiving a reward. As we already mentioned, the easiest way to mine Bytecoin is utilizing ASICs. Bytecoin is among the greatest cash to choose if you want to mine cryptocurrencies.

How to Mine BCN: Our Top 5 Recommendations

You will then be presented with a series of steps that will guide you through the first time initialization of the software. Once you have completed this, you will not need to do this again. In this little experiment, we will see if mining on a Pi Zero is possible or practical. For this example I am using a Pi Zero W running Raspbin Lite. If you are not familiar with the Pi Zero W, it’s a super tiny variation of the Raspberry Pi with a single-core ARM1176JZF-S CPU rated at 1.0 how to mine bytecoin GHz. The ‘W’ version comes with wifi support which I recommend since none of the Zeros come with Ethernet support.

Is it illegal to mine for Bitcoin?

Bitcoin mining is legal in most countries, but several jurisdictions have already banned it. China, one of the world's largest economies, outlawed bitcoin mining in 2021, and the nation's government has also prohibited all cryptocurrency transactions.

The reliability of Bytecoin is defined by the total computational power of all the computers that take part in the processing of transactions. The greater the processing power, the more reliable the network. Bytecoin emission is completely different to that of fiat currencies, as that is a closed process. Bytecoin emission, on the contrary, is open and uses computing power from all the network members. Any user can join the network and help to emit Bytecoin, which in turn makes them miners. Please make sure the pool is not already in the BCN mining pools list.

Some popular BCN mining pool you can consider joining is bytecoin.uk, Miner gate, and bytecoin-pool.

The miners are the main contributors in the network’s health as they are the most rational users on the chain.

The emission of fiat currencies is a closed process where an issuer is engaging in its own capabilities.

Some popular ASICs are Bitmain – Antminer X3, Antiminer S19 Pro, Halong Mining – DragonMint X1, and AVALOminer 1245.

You can trade Vertcoin rewards on Coinex, Bittrex, SouthXchange, and Finexbox.

You can mine Ethereum using GPUs such as ZOTAC Gaming GeForce RTX 3090 and ASUS ROG Strix AMD Radeon RX 5700XT. They dont require special adjustment and can be used globally. The main reason miners search for the easiest coin to mine 2023 is because crypto mining is now more difficult than it was a few years ago. Bitcoin mining, for example, becomes two times harder every four years.

A COMPLETE GUIDE TO PI NETWORK:

It’s up to you weather to use Bytecoin out-of-the-box or modify its code to fit your own requirements. Playing around with Bytecoin features is a great experience. The Bytecoin wallet is now open and syncing to the blockchain for the first time.

To create a permanent address, navigate to the receive tab on the main dashboard of the software. You can create a new address and set it to never expire to use it for the mining set-up. Once mined, exchanges that trade Beam include Binance and Bitforex. The Digital Asset Mining Energy (DAME) tax was a proposed excise tax that was included in President Biden’s 2024 federal budget proposal. This tax on cryptocurrency miners would amount to up to 30% of miners’ electricity costs.

How to get 1 BTC in a day?

Earning 1 Bitcoin per day without any investment is possible, but it requires time, effort, and dedication. By leveraging methods such as mining, faucets, affiliate marketing, freelancing, airdrops, and bounties, you can achieve your goal of accumulating 1 Bitcoin per day.

0 notes

Text

Market Anxiety Rises as Justin Sun Liquidates ETH Holdings

Key Points

Justin Sun, founder of Tron, reportedly sold half of his Ethereum (ETH) holdings, causing market concerns.

Despite the sell-off, some analysts predict Ethereum could regain momentum and potentially exceed the $4,000 resistance level.

Justin Sun, the creator of Tron, is believed to have sold a significant portion of his Ethereum (ETH) holdings, according to recent reports from the cryptocurrency market. Data from blockchain analytics firm Spot On Chain indicates that Sun has sold 50% of his remaining ETH over the past week, equating to $143 million.

This sell-off by Sun follows a broader trend of sell-offs as ETH prices continue to fall, having failed to surpass the $4,000 resistance level. In fact, the price of ETH has dropped by 17% during the period under review, placing additional pressure on Ethereum and leaving market participants pondering the future.

Ethereum’s Uncertain Future Amidst Justin Sun’s Selling Spree

Spot On Chain has shown that Sun recently redeemed 39,999 ETH through platforms such as Lido Finance and EtherFi, before depositing the entire amount into HTX (formerly Huobi Exchange).

Overall, since November 10, Sun has transferred no less than 108,919 ETH into HTX, which is approximately $400 million worth of Ethereum. However, market fears are not over yet. Sun still holds 42,904 ETH (around $139 million), which is currently unstaking from Lido Finance. Therefore, it’s entirely possible that he may deposit this amount into HTX as well.

These ongoing sell-offs, particularly by a high-profile figure like Sun, have undoubtedly contributed to the current bearish sentiment for Ethereum. Some market experts predict that Ethereum’s price could drop below the $3,000 mark in the near future.

Is There Hope for Ethereum?

Despite the bearish outlook, some analysts believe Ethereum could soon regain its momentum. A well-known crypto strategist identified a potential inverse head-and-shoulders (iHS) pattern forming on the Ethereum price chart. If this pattern is confirmed, it could push ETH beyond the $4,000 resistance level.

This strategist suggests that Ethereum may experience a breakout by late January. However, he also noted that Ethereum might first retest the $3,000 level before rallying. Despite the recent sell-off, those who have recently purchased Ethereum are still making some profit, which could provide temporary support for the market.

At the time of reporting, ETH was trading at $3,293.

0 notes

Text

IEO Launchpad Explained

An IEO Launchpad is a platform that helps new cryptocurrency projects raise funds through an Initial Exchange Offering (IEO). Unlike traditional fundraising, in an IEO, projects conduct their sales through a cryptocurrency exchange. This method provides greater credibility and security for investors, as the exchange acts as an intermediary.

IEOs have gained popularity because they simplify the fundraising process for projects while also ensuring that investors are protected. Investors can buy tokens directly on the exchange, making it easier to participate in exciting new projects. In recent years, many successful projects have launched on IEO launchpads, attracting significant investor interest.

Benefits of Using an IEO Launchpad

There are several advantages of utilizing an IEO launchpad for both projects and investors. First, it provides a level of trust, as exchanges typically perform due diligence on projects before allowing them to launch. This vetting process helps reduce the risk of scams.

For investors, participating in an IEO is often more straightforward. They can use their existing exchange accounts to purchase tokens. Additionally, IEOs often have liquidity right after launch, making it easier to trade tokens. Here are some key benefits:

Increased visibility for projects due to exchange promotion.

Security from the exchange’s vetting process.

Easy access for investors with existing accounts.

How Does an IEO Launchpad Work?

Launching an IEO involves multiple steps, starting with submitting a proposal to an exchange. Once approved, the project collaborates with the exchange to create a marketing strategy and establish a timeline. Utilizing a Crypto Press Release Distribution Service can amplify your outreach, ensuring a wider audience and a more successful launch.

Once the launch day arrives, investors can start buying tokens on the platform. The exchange usually handles the fundraising and distribution of tokens, so both projects and investors benefit from a streamlined process. Here’s a general overview of the steps:

Project submission to the exchange.

Due diligence and approval by the exchange.

Marketing and preparation for the IEO.

Launch and token distribution.

Popular IEO Launchpads

There are many well-known IEO launchpads in the market. Each of these platforms has its own unique features and advantages. Here are some of the most popular:

Binance Launchpad - One of the most recognized platforms, known for its large user base.

Huobi Prime - Offers a simple and efficient way to invest in new projects.

KuCoin Spotlight - Focuses on innovative projects with strong potential.

Choosing the right launchpad can make a significant difference in a project's success. It's essential to consider factors like the platform's reputation, user base, and the types of projects they typically host.

Challenges of IEO Launchpads

Despite their advantages, IEO launchpads also face challenges. For instance, the approval process can be quite rigorous. Not every project will get the chance to launch on a top exchange due to strict criteria. This can limit opportunities for some developers.

Additionally, while IEOs are generally safer than initial coin offerings (ICOs), they still come with risks. Investors need to research projects thoroughly before investing. Understanding the project's goals, team, and market potential is crucial for making informed decisions. Here are some challenges to consider:

High competition among projects for launch slots.

Regulatory concerns affecting the launch process.

Risk of market volatility post-launch.

Future of IEO Launchpads

The future of IEO launchpads looks promising as more projects seek funding through this method. As the cryptocurrency space evolves, we may see greater integration of technology and compliance measures. This evolution could lead to even more robust platforms that benefit both projects and investors.

Furthermore, as investors become more educated about the crypto market, the demand for secure and reliable fundraising methods like IEOs may increase. It's an exciting time to be involved in the world of IEO launchpads, and we can expect to see innovative developments in the coming years.

Conclusion

In summary, an IEO launchpad is a powerful tool for raising funds in the cryptocurrency space. With benefits like increased visibility, security, and ease of access, it's no wonder that many projects are turning to IEOs for funding. By understanding how IEOs work and the challenges they face, both investors and projects can make better decisions in this evolving landscape.

Whether you're an aspiring project developer or an enthusiastic investor, exploring the world of IEO launchpads can open up exciting new opportunities. Remember to stay informed and conduct thorough research to maximize your chances of success in this dynamic market!

youtube

FAQs about IEO Launchpads

What is an IEO Launchpad? An IEO Launchpad is a platform that assists new cryptocurrency projects in raising funds through an Initial Exchange Offering (IEO), providing greater credibility and security for investors.

What are the benefits of using an IEO Launchpad? Key benefits include increased visibility for projects, security from the exchange's vetting process, and easy access for investors with existing accounts.

How does the IEO Launchpad process work? The process typically involves project submission to the exchange, due diligence and approval, marketing preparation, and the actual launch and token distribution.

What are some popular IEO Launchpads? Some well-known IEO launchpads include Binance Launchpad, Huobi Prime, and KuCoin Spotlight, each offering unique features and advantages.

What challenges do IEO Launchpads face? Challenges include high competition for launch slots, regulatory concerns, and the risk of market volatility post-launch.

What does the future hold for IEO Launchpads? The future appears promising, with potential for greater integration of technology and compliance measures, increasing demand for secure fundraising methods.

Follow Us Weebly | Twitter | Gravatar | Disqus | Youtube | About.Me | Google Sites | Blogger

1 note

·

View note

Text

Revolutionizing Crypto with MemeCash: Join the Presale Now!

December 12, 2024 – In the ever-evolving world of cryptocurrency, a groundbreaking project is capturing attention worldwide. MemeCash is here to revolutionize the crypto landscape by blending meme culture with cutting-edge blockchain technology. As we gear up for our global debut, we invite crypto enthusiasts and investors to join us at this pivotal presale stage, setting the stage for a dynamic and promising future.

Why MemeCash?

MemeCash is not just another token; it’s a movement aimed at uniting the vibrant meme community with practical utility in the crypto space. By combining the lightheartedness of memes with robust tokenomics and a strategic roadmap, MemeCash aims to create an ecosystem that stands out in a crowded market.

Key Features of MemeCash:

● Innovative Tokenomics: Designed to incentivize early adopters while ensuring

long-term value.

● Global Community Building: Strong focus on community engagement via platforms like Telegram and Twitter.

● Strategic Exchange Listings: From decentralized exchanges (DEX) like Coingecko, CoinMarketCap, DexScreener, and Radium to centralized exchanges (CEX) such as Bitget, KuCoin, and OKX, MemeCash is set to dominate the trading landscape.

● Generous Airdrop Program: To expand our reach, MemeCash will distribute tokens through exciting airdrops on Twitter and Telegram.

Presale Now Live – Don’t Miss Out!

Investors can now participate in the MemeCash presale, an exclusive opportunity to secure tokens at an early stage. With the presale gaining momentum, this is your chance to become part of a transformative journey.

Future Insights: What’s Next for MemeCash?

● DEX Launch: Post-presale, MemeCash will be launched on top-tier decentralized exchanges, including Coingecko, CoinMarketCap, and DexView, ensuring accessibility and liquidity.

● CEX Listings: The roadmap includes strategic listings on industry-leading centralized exchanges such as Bitfinex, MEXC, Huobi, and Gate.io, further amplifying MemeCash’s visibility and global adoption.

● Airdrops and Community Rewards: To foster engagement and reward loyal supporters, MemeCash will conduct large-scale airdrops across social platforms.

● Building a Legacy: MemeCash envisions a future where blockchain technology and meme culture coexist, providing value to both the crypto-savvy and newcomers alike.

Why the World is Watching...?

The buzz around MemeCash is undeniable. With a roadmap that includes major listings,

community rewards, and unmatched accessibility, MemeCash is well-positioned to become a significant player in the cryptocurrency ecosystem. By addressing both the fun and functional aspects of crypto, MemeCash bridges the gap between speculative investments and utility-driven blockchain projects.

Join the Movement

Don’t miss your chance to be part of this game-changing project. Whether you’re an investor, a crypto enthusiast, or someone looking to engage with a thriving community, MemeCash has something to offer.

Media Contact:

MemeCash Team

Website: https://memecash.cash/

Twitter: https://x.com/MemeCashMC?t=Jjl0AdotfXFhw3B7nDk8zg&s=09

Telegram: https://t.me/MCashToken

Presale Link : https://tools.smithii.io/launch/MemeCash

About MemeCash

MemeCash is a blockchain-based project dedicated to creating value through innovation, community building, and strategic growth. With a vision to make crypto accessible and enjoyable for everyone, MemeCash is paving the way for a future where memes and technology

merge seamlessly.

#MemeCash #CryptoRevolution #PresaleLive #$MCash

0 notes

Text

Prosegue l’incredibile rally di Bitget Token (BGB) - acquistabile con bonus su Bitget - che attualmente quota 3,069 USDT, registrando un rialzo settimanale del 12,60%. La crescita di dicembre si attesta a +89%, dopo un mese di novembre già chiuso a +41%. Complessivamente, BGB ha segnato un impressionante incremento del 165% negli ultimi 40 giorni. Bitget Token prosegue il Rally: +163% in 40 Giorni Il trend rialzista del mercato crypto, iniziato il 5 novembre con l’elezione di Trump, ha spinto diverse crypto, tra cui BGB, che rientra nella categoria delle crypto emesse dagli exchange. Questi token offrono vantaggi specifici agli utenti che li detengono, come: sconti commissionali sul trading, staking con rendimenti competitivi e in alcuni casi cashback su carte di debito. L'attuale performance di BGB, va oltre gli effetti post-elezione di Trump, ed è legata ad una serie di funzionalità sulla piattaforma Bitget, già analizzate in dettaglio nell’articolo: BGB: la crypto di Bitget è tra le migliori della Bull Run. Cresce il comparto degli utility Token di Exchange Il momento è particolarmente favorevole per Bitget Token, ma anche altri utility token emessi dagli exchange stanno mostrando performance significative. Tra i più noti figurano in ordine sparso, Binance Coin, KuCoin, OKB, GateToken (GT), Cripto.com (CRO) e Huobi Token, per citare i più noti. Nel grafico allegato è riportata una panoramica dell’andamento di questi token da inizio novembre, con $BGB che domina la scena, seguito da $CRO. Andamento storico del prezzo di $BGB $BGB è stato introdotto sulla piattaforma Bitget nel 2020, ma è stato quotato sull’exchange solo nel gennaio 2022. Al momento del lancio, il prezzo iniziale si attestava intorno a 0,16 USD. Da allora, il valore della crypto ha seguito un trend rialzista, intervallato da fasi correttive, pause e rimbalzi, come evidenziato dal grafico monthly. Bitget (BGB) -Monthly Dicembre 2024 Rialzo di Dicembre e ATH in aggiornamento continuo Osservando la crescita recente, spicca il rialzo di dicembre, che ha raggiunto il +90% e potrebbe superare il record di febbraio 2023, quando BGB aveva segnato un +95%. Il prezzo di Bitget Token sta registrando nuovi massimi in modo estremamente rapido. Attualmente, il valore ha raggiunto un nuovo ATH a 3,1536 USDT, con possibilità di ulteriori incrementi. Analisi del Rally di Bitget Passando ad un’analisi più dettagliata degli ultimi movimenti del prezzo di Bitget, osserviamo il suo andamento degli ultimi due mesi sul grafico daily. La crescita di Bitget non è stata del tutto una sorpresa, poiché l’avevamo già segnalata il 26 settembre: ...il breakout di questo livello riporterebbe Bitget in un’area bullish con possibile obiettivo verso un nuovo massimo. Alessandro Lavarello – Trader professionista e analista di Criptovaluta.it Bitget (BGB) -11 Weekly Dicembre 2024 Un Rialzo Esponenziale in Tre Mesi Ovviamente, non si poteva prevedere un rialzo così esponenziale nell’arco di tre mesi. L’accelerazione di $BGB è avvenuta a inizio dicembre, quando il prezzo ha toccato un minimo a 1,49 USDT, configurando una candela doji. Il 4 dicembre, il prezzo ha raggiunto un massimo a 2,968 USDT, per poi ritracciare fino al primo supporto in area 2,40 USDT, da dove è ripartito al rialzo con una nuova leg up. Nella parte inferiore del grafico, i volumi in costante crescita sostengono questo rally. Sul breve discesa e recupero del prezzo Nella giornata di ieri, con una discesa generalizzata del mercato crypto, il prezzo di Bitget ha registrato una perdita del 10,20%. Tuttavia, nella giornata odierna, al momento di questa stesura, il prezzo è in crescita del 10,60%, evidenziando una forte capacità di recupero. Supporti chiave per Bitget Su questa panoramica, sono stati evidenziati due attuali supporti: - Il primo livello si trova in area 2,36 USDT; - Il supporto principale è situato a 2,15 USDT. Read the full article

0 notes

Text

Investing in Emerging Markets through Initial Exchange Offerings (IEOs)

The cryptocurrency landscape is rapidly evolving, bringing numerous investment opportunities. One exciting option gaining traction is investing in emerging markets through Initial Exchange Offerings (IEOs). This blog will explore how IEOs act as a gateway for investors to tap into emerging markets, the benefits they offer, and strategies to navigate this dynamic environment.

Understanding Initial Exchange Offerings (IEOs)

An Initial Exchange Offering (IEO) is a fundraising method where a cryptocurrency exchange serves as an intermediary between project developers and investors. Unlike traditional Initial Coin Offerings (ICOs), in which tokens are sold directly to the public, IEOs leverage the credibility and infrastructure of established exchanges. This arrangement offers several advantages:

Credibility: Exchanges thoroughly vet projects before listing them, boosting investor confidence.

Immediate Trading: Tokens are usually available for trading immediately after the IEO, providing liquidity for investors.

Why Invest in Emerging Markets?

Emerging markets present unique opportunities for investors, characterized by rapid economic growth, increased internet penetration, and a rising middle class. These regions offer the potential for high returns, particularly in technology and finance, making them attractive targets for cryptocurrency investments.

Benefits of Investing Through IEOs

Access to Innovative Projects: IEOs often feature cutting-edge projects that are not available through traditional investment channels. This allows early investment in promising opportunities.

Reduced Risk: Since exchanges conduct due diligence before listing projects, the risk of scams or poorly managed ventures is significantly reduced compared to traditional ICOs.

Liquidity: Immediate trading availability post-IEO enables investors to quickly liquidate their positions if needed, offering flexibility in managing portfolios.

Community Engagement: Many IEOs encourage community participation, giving investors a chance to engage with projects and provide feedback.

How to Navigate IEOs in Emerging Markets

Conduct Thorough Cryptocurrency Research

Before investing in any IEO, it's essential to conduct a deep analysis. Review the project’s whitepaper, roadmap, and team credentials to assess its potential. Resources like an ICO calendar can help track upcoming ICOs and IEOs.

Monitor Upcoming ICO and IEO Lists

Staying informed about upcoming ICO lists helps investors identify promising projects launching through IEOs. Platforms frequently update their lists of upcoming IDOs and IEOs, making it easier to stay on top of opportunities.

Evaluate Launchpad Platforms

Many IEOs are conducted on launchpad platforms, which facilitate token sales for new projects. Researching the best crypto launchpads can provide insights into platforms with a strong track record of successful offerings.

Participate in Airdrop Campaigns

Some projects offer crypto airdrops as part of their marketing strategy. Participating in these campaigns can enhance your portfolio by providing free tokens.

Popular Platforms Hosting IEOs

Several platforms have become key players in the IEO ecosystem:

Binance Launchpad: Known for its robust security and large user base, Binance has hosted numerous successful IEOs.

Huobi Prime: A curated selection of high-quality projects, known for its rigorous vetting process.

OKEx Jumpstart: Focuses on innovative blockchain projects, offering exclusive token sales.

Polkastarter: A decentralized launchpad allowing projects to raise funds across multiple blockchains, offering easy participation for users.

Future Trends in IEOs

As the cryptocurrency landscape continues to evolve, several trends are shaping the future of IEOs:

Increased Regulation: As governments worldwide tighten cryptocurrency regulations, projects will need to ensure compliance to maintain investor interest.

DeFi Integration: Many upcoming ICOs and IEOs are exploring Decentralized Finance (DeFi) integration, enhancing their appeal and use cases.

Focus on Sustainability: Projects that emphasize sustainability and social impact are gaining favor with investors, especially in emerging markets.

Conclusion

Investing in emerging markets through Initial Exchange Offerings (IEOs) presents a compelling opportunity for investors seeking to diversify their portfolios and capitalize on high-growth potential regions. By conducting thorough research, tracking upcoming ICOs and IDOs, and exploring platforms like Binance and Polkastarter, investors can tap into the dynamic world of cryptocurrency investments. As emerging markets continue to evolve, IEOs remain an exciting avenue for growth and innovation.

0 notes

Text

HTX Clone Script: Build Your Own Cryptocurrency Exchange with Spot & Futures Trading

HTX Clone Script is a comprehensive, pre-built software solution that enables entrepreneurs to swiftly launch their own cryptocurrency exchange, mirroring the successful features of the HTX (Huobi Token Exchange). This script is designed to facilitate both spot and futures trading, making it an attractive option for those looking to enter the competitive crypto market.

Key Features of HTX Clone Script

User-Friendly Interface: The platform is designed with an intuitive interface that enhances user experience, catering to both novice and experienced traders.

Multi-Currency Wallet Integration: Users can securely manage and trade various cryptocurrencies through integrated wallets, ensuring safe storage and transactions.

Advanced Trading Engine: The clone script includes a powerful trading engine that supports high trading volumes, enabling quick and efficient trade execution.

Asset Management System: This feature provides tools for portfolio management, performance analytics, and tracking, allowing users to manage their investments effectively.

Robust Security Measures: Security is prioritized with features like SSL encryption, two-factor authentication (2FA), KYC/AML compliance, and DDoS protection to safeguard user data and transactions.

Cross-Platform Compatibility: The platform is accessible across multiple devices, ensuring a seamless trading experience whether on desktop or mobile.

Customizable and White-Label Solutions: The HTX clone script can be tailored to meet specific business needs, allowing for branding and feature modifications to differentiate in the market.

Benefits of Using HTX Clone Script

Quick Deployment: The ready-made nature of the script allows for rapid launch, enabling businesses to enter the market sooner.

Cost-Effective: Developing a cryptocurrency exchange from scratch can be expensive and time-consuming. The clone script reduces both development time and costs.

Proven Model: By leveraging the established features of the HTX exchange, the clone script provides a reliable foundation that can attract users.

Revenue Generation: The platform can incorporate various revenue models, such as trading fees, withdrawal fees, and premium features, to generate income.

Steps to Launch Your Crypto Exchange

Conduct Market Research: Identify your target audience and establish your unique value proposition.

Select a Reputable Provider: Choose a trusted provider of HTX clone scripts that offers customization options and robust support.

Customization and Development: Work with developers to customize the script according to your branding and specific feature requirements.

Testing: Conduct thorough testing to ensure the platform is secure and functions correctly before launch.

Launch and Marketing: Once testing is complete, launch your platform and implement a marketing strategy to attract users.

Utilizing an Dappfort HTX clone script offers a strategic and efficient way to establish a cryptocurrency exchange, providing a robust foundation with key features already integrated, thus enabling businesses to compete effectively in the rapidly evolving crypto market.

#htxclonescript#htxexchangescript#cryptocurrency exchange development#cryptocurrency exchange script#blockchain#crypto traders#cryptonews#business#startups#singapore#usa#uk

0 notes

Text

Start a HTX-Like Crypto Exchange With Advanced Features

Starting a cryptocurrency exchange like HTX, formerly known as Huobi, can be a lucrative endeavor, especially with the increasing global interest in digital assets. The key to success in this competitive market lies in incorporating advanced features that enhance user experience, security, and scalability. With a robust HTX Clone Script, you can easily launch a crypto exchange that mirrors the functionalities of HTX while offering unique elements tailored to your brand.

Why Consider an HTX Clone Script?

The HTX Clone Script is a pre-engineered software solution designed to replicate the core features of the HTX exchange. It enables entrepreneurs to kickstart their cryptocurrency exchange journey without the need to develop a platform from scratch. This clone script is fully customizable, allowing you to add or modify features to meet your business needs. Whether you want to integrate advanced trading options, enhanced security measures, or user-friendly interfaces, the HTX Clone Script is flexible enough to accommodate your requirements.

Key Features of an HTX Clone Script

Advanced Trading Engine: The backbone of any crypto exchange is its trading engine. The HTX Clone Script comes with a high-performance trading engine capable of processing thousands of transactions per second. This ensures smooth trading experiences even during peak times.

Security Protocols: Security is paramount in the crypto industry. The HTX Clone Software is equipped with multi-layer security protocols, including two-factor authentication, SSL encryption, and cold wallet integration, to safeguard users' assets and data.

Multi-Currency Support: With the HTX Clone Script, you can offer support for a wide range of cryptocurrencies. This feature attracts a larger user base, as traders prefer exchanges with diverse trading pairs.

User-Friendly Interface: A well-designed user interface can make or break your exchange. The HTX Clone Software provides an intuitive and easy-to-navigate platform that caters to both novice and experienced traders.

Liquidity Management: Ensuring liquidity is crucial for the success of any exchange. The White Label HTX Clone Software includes liquidity management tools that help maintain a healthy order book, encouraging more users to trade on your platform.

Mobile Compatibility: With the increasing use of smartphones for trading, having a mobile-friendly platform is essential. The HTX Clone App allows users to trade, deposit, withdraw, and monitor the market on the go, providing a seamless trading experience across devices.

White Label HTX Clone Software: A Customized Solution

For those looking to launch a unique brand, White Label HTX Clone Software is the ideal solution. This version of the clone script is fully customizable, allowing you to modify the UI/UX design, integrate additional features, and even rebrand the entire platform. This gives you the flexibility to create a crypto exchange like HTX, but with your own distinct identity.

Why Choose Plurance?

When it comes to developing a crypto exchange, choosing the right technology partner is crucial. Plurance is a top-rated cryptocurrency exchange script provider, known for delivering high-quality, secure, and scalable solutions. With a Plurance-developed HTX Clone Script, you can be assured of a robust platform that meets industry standards and exceeds user expectations.

Conclusion

Starting a crypto exchange like HTX doesn't have to be a daunting task. By leveraging an HTX Clone Script, you can quickly enter the market with a feature-rich platform. Whether you're aiming to replicate HTX’s success or carve out your own niche, the flexibility and advanced features of the HTX Clone Software make it possible. Partner with Plurance, and take the first step toward creating a world-class cryptocurrency exchange today.

0 notes

Link

Supply: AdobeStock / Iryna BudanovaBinance, the world's largest cryptocurrency alternate, has seen a pointy drop in market share amongst non-dollar crypto exchanges.In keeping with data by The Block, Binance's market share amongst a gaggle of exchanges that features main Asian gamers like Upbit, Huobi, Bybit, and OKX hit 54% in August and is projected to additional drop to below 51% in September.This comes because the alternate had a 75% market share amongst these exchanges on the finish of 2022. Again in June, the Monetary Occasions reported that Binance's market share had shrunk by 25% through the interval between February to June. The report claimed that the world's largest cryptocurrency alternate accounted for 57.5% of the common month-to-month quantity of all crypto trades in February, however its market share dropped to 43% by the top of Might. In the meantime, Binance co-founder Yi He has addressed the alternate's shrinking market share in a current letter to firm staff.She stated that staff ought to be targeted on creating glorious merchandise and offering a superb person expertise for all clients no matter regulatory strain or opponents' progress.Yi He in contrast the continuing scenario with the crypto recession of 2019. She recalled that again then, Binance was not delivering a lot of its present merchandise, together with a fiat gateway, Binance P2P, Binance Futures, and extra. However even then, Binance managed to develop into a frontrunner and "turn the tables" within the section."This is not the first time, nor it will be the last showdown (...) Every battle is a do-or-die situation, and the only thing that can defeat us is ourselves."Binance Grapples With Growing Regulatory ScrutinyBinance has been below heightened regulatory scrutiny globally for the reason that market turbulence of the earlier yr.In June, the SEC sued Binance and its CEO for his or her “blatant disregard of the federal securities laws,” unveiling 13 costs towards the platform, together with working an unregistered alternate.The company accused Binance of breaking the regulation by providing unregistered securities to most people, together with its BNB token and BUSD stablecoin.Likewise, French authorities performed a go to to Binance's workplace in France final month. They're investigating allegations of unlawful provision of digital asset providers and aggravated cash laundering.The exchange was also ordered to cease operations in Nigeria by the nation's Securities and Change Fee (SEC).Binance has additionally confronted regulatory challenges in a number of European nations, akin to Belgium and Austria, because it prepares to adjust to the EU's forthcoming Markets in Crypto Property (MiCA) rules.Extra lately, a number of the alternate's clients within the EU were blocked from withdrawing euros as a part of an early change within the crypto alternate’s regional funds supplier looms.

0 notes

Text

Huobi Token (HT) Price Prediction 2025, 2026, 2027, 2028, 2029 and 2030

Welcome to our comprehensive article that aims to provide a yearly price prediction for Huobi Token (HT) from 2025 to 2030.

We have meticulously analyzed key technical indicators and market dynamics to offer you these forecasts.

Our purpose is to give you an informed perspective on the potential future value of HT, based on current and projected market trends.

We believe that understanding these trends can help you make more informed investment decisions.

Huobi Token (HT) Long-Term Price Prediction

Year Lowest Price Average Price Highest Price 2025 $30 $40 $50 2026 $35 $45 $60 2027 $25 $35 $45 2028 $20 $30 $40 2029 $30 $45 $60 2030 $40 $55 $70

Huobi Token Price Prediction 2025

By 2025, the crypto market is expected to be embraced more by the mainstream financial institutions which would pump more capital into the industry.

Huobi Token’s lowest price is projected at $30, with an average price of $40 – driven by the greater adoption and utility of the HT token.

The highest price may hit $50 as global macroeconomic factors and favorable regulations increase the appeal of cryptocurrencies.

Huobi Token Price Prediction 2026

2026 is also a high growth year, with the token’s value potentially increasing to a high of $60.

The average price could increase to $45 fuelled by a favorable tech sector especially with blockchain adoption growing across various industries.

Huobi Token Price Prediction 2027

A correction is anticipated in 2027, with the lowest price falling to $25 and the highest price dropping to $45.

Despite the more moderate prices, the average price in this year at $35 is still quite resilient reflecting the maturity of the crypto market.

Huobi Token Price Prediction 2028

Further correction might occur in 2028 as the industry settles to the more reasonable values in comparison with the booming growth years.

The expected lowest price is predicted at $20, while the highest price at $40. The average price could also drop to $30 for the year.

Huobi Token Price Prediction 2029

In 2029, the Huobi token is expected to regain momentum, with a lowest price at $30.

The optimistically projected average price could go up to $45 and the highest price could reach $60 due to renewed interest and investment flows into the crypto sector.

Huobi Token Price Prediction 2030

Expectations for the year 2030 are highly optimistic with the lowest price being around $40.

The average price may continue to rise to $55, reflecting steady adoption and utility, with a potential peak at $70, underlining the sustained growth and relevance of Huobi Token and the wider crypto market.

Huobi Token (HT) Fundamental Analysis

Project Name Huobi Token Symbol HT Current Price $ 0.450002 Price Change (24h) -5.89% Market Cap $ 73.0 M Volume (24h) $ 322,814 Current Supply 162,233,844

Huobi Token (HT) is currently trading at $ 0.450002 and has a market capitalization of $ 73.0 M.

Over the last 24 hours, the price of Huobi Token has changed by -5.89%, positioning it 421 in the ranking among all cryptocurrencies with a daily volume of $ 322,814.

Unique Technological Innovations of Huobi Token

Huobi Token (HT) stands out with a range of distinctive technological features that offer competitive advantages in the crypto market.

Huobi, the third largest cryptocurrency exchange in the world, developed Huobi Token to provide users with more flexibility and better benefits in terms of transactional fees.

One of the primary innovations of HT is its application in the Huobi exchange ecosystem, allowing users to leverage HT for lower transaction fees, discounts, and access to premium features such as the IEO on Huobi prime.

Moreover, Huobi Token employs a user-centric design under a robust security framework.

Notably, it collaborated with an international cybersecurity team to enhance its risk controls, forging a secure and reliable ecosystem for its users.

The combination of the token’s utility, increased security, and user-friendly platform addresses current market needs and contributes to its competitive positioning.

Strategic Partnerships and Collaborations

Huobi Token has established various strategic partnerships that support wider adoption and enhance its ecosystem.

For instance, it strategically partnered with Global Digital Finance (GDF), a major industry body advocating adoption of best practices for crypto-assets.

This partnership paved the way for Huobi Token to further legitimize and expand businesses in the crypto-assets space.

Additionally, Huobi collaborated with Nervos, a blockchain network, to develop a decentralized finance (DeFi) solution.

This project aims to create multi-asset (including HT) storage and transactional infrastructure, which would capitalize on the growing demand for DeFi applications, thus boosting its adoption.

Sustainability Strategies in the Cryptocurrency Market

To maintain its competitiveness, Huobi Token continuously adapts its strategies and services to meet changing market trends, technology advancements and potential regulatory shifts.

Part of this strategic adaptation includes expanding its offerings, such as incorporating futures trading, margin trading and staking services.

Moreover, Huobi Token effectively responds to regulatory changes by proactively engaging with regulators and governments.

For example, Huobi obtained licenses to operate in various jurisdictions, thereby gaining access to regulated markets and imparting a sense of security among its users.

Community Engagement: The Heart of Huobi Token’s Success

Huobi Token’s community engagement forms a significant part of its growth and adoption strategy. The company maintains active platforms on major social media channels such as Twitter, Telegram, and Reddit where they share updates, seek user feedback, and address customer concerns.

Moreover, Huobi Token has introduced initiatives such as Huobi Global Elites Program, aimed at incentivizing individual and institutional users to contribute to the Huobi ecosystem exchange’s growth.

Through these strategies, Huobi Token has fostered an engaged and proactive community of users, further maximizing its potentials in the cryptocurrency space.

Huobi Token (HT) Technical Analysis

Zoom

Hour

Day

Week

Month

Year

All Time

Type

Line Chart

Candlestick

Technical Analysis is a trading discipline employed to evaluate investments and identify opportunities by analyzing statistical trends gathered from trading activity.

It’s important because it provides a graphical illustration of HT’s price movements, and help traders predict future price movements with more accuracy and make more informed investment decisions.

Three indicators include:

Moving Averages: These smooth out price data by creating a constantly updated average price to identify a price trend.

Volume: This shows the number of HT being traded over a particular time period. If a price jumps, an increase in volume shows a stronger move.

Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. RSI ranges from 0 to 100, and typically, when RSI goes over 70, it may indicate that the asset may be getting overbought and could be a sign of a possible sell-off in the future.

Huobi Token Price Predictions FAQs

What is Huobi Token (HT)?

Huobi Token (HT) is an exchange-based token and native digital currency of the Huobi crypto exchange. The HT can be used for a variety of things like discounts for transaction fees, rewards for users, participation in exchange governance and many more.

Is Huobi Token a good investment?

Whether Huobi Token is a good investment or not depends entirely on the investor’s personal financial situation, risk appetite, and investment strategy.

However, considering its utility within the Huobi Exchange and its adoption rate, some investors find it a lucrative investment in the long term.

What will be the future price of Huobi Token?

As with any cryptocurrency, the future price of Huobi Token depends on various factors like market trends, investor sentiment, adoption of the token, regulatory news, and overall health of the cryptocurrency market.

It is recommended to conduct individual research and consider taking professional financial advice before investing.

Can Huobi Token reach $100?

While it is technically possible, predicting price levels such as $100 for Huobi Token is speculative and impossible to guarantee. It would require significant growth and positive changes in the market.

What is CoinEagle.com?

CoinEagle.com is an independent crypto media platform and your official source of crypto knowledge. Our motto, “soaring above traditional finance,” encapsulates our mission to promote the adoption of crypto assets and blockchain technology.

Symbolized by the eagle in our brand, CoinEagle.com represents vision, strength, and the ability to rise above challenges. Just as an eagle soars high and has a keen eye on the landscape below, we provide a broad and insightful perspective on the crypto world.

We strive to elevate the conversation around cryptocurrency, offering a comprehensive view that goes beyond the headlines.

Recognized not only as one of the best crypto news websites in the world, but also as a community that creates tools and strategies to help you master digital finance, CoinEagle.com is committed to providing you with the necessary knowledge to win in crypto.

Disclaimer: The Huobi Token price predictions in this article are speculative and intended solely for informational purposes. They do not constitute financial advice. Cryptocurrency markets are highly volatile and can be unpredictable. Investors should perform their own research and consult with a financial advisor before making any investment decisions. CoinEagle.com and its authors are not responsible for any financial losses that may result from following the information provided.

0 notes